"Subject To": Is It Legal?

This is a subtitle for your new post

"Subject To?" Simply buying property subject to the existing mortgage or financing.

The seller deeds the property to the buyer and the sellers financing remains in place.

I've seen this: "some states and brokers do not "encourage" these types of transactions...check with your state or managing broker before doing these."

Notice they said "do not encourage", not that the transactions are illegal. Buyers getting houses "subject to" is mentioned in virtually all real estate training manuals in every state.

Notice I said mentioned? They just don't teach how to do it! Why?

Here's an excerpt from “Modern Real Estate Practice” one of many real estate training manuals that is used throughout the U.S. and is used by virtually all states as a guideline for real estate training manuals specific for their state.

QUOTE FROM “MODERN REAL ESTATE PRACTICE” – (Dearborn Press)

“When a person purchases real estate that has an outstanding mortgage or deed of trust, the buyer may take the property in one of two ways. The property may be purchased subject to the mortgage or deed of trust, or the buyer may assume the mortgage or deed of trust and agree to pay the debt.

The technical distinction becomes important if the buyer defaults and the mortgage or deed of trust is foreclosed.

When the property is sold subject to the mortgage, the buyer is not personally obligated to pay the debt in full. The buyer takes title to the real estate knowing that he or she must make payments on the existing loan.

Now in the event of a default, the lender forecloses and the property is sold by court order to pay the debt. If the sale does not pay off the entire debt, the purchaser is not liable for the difference. In some circumstances, however, the original seller might continue to be liable.

For example: Robert owns an investment rental property that carries a mortgage. For health reasons, he wants to sell the property to Janet who has been managing the property and who also wants to use the rental property as an investment.

Robert sells the property to Janet " subject to the mortgage" . In the sale, Janet takes title and assumes responsibility for the loan , but lets say after two months something happens and she can no longer make payments on the loan.

There is a foreclosure sale and because Robert sold the property subject to the mortgage, Robert (not Janet) is personally liable

if proceeds from the foreclosed sale do not meet the obligations.

In contrast, a buyer who purchases the property and assumes the seller's debt (which is a mortgage assumption not "Subject To" ) becomes personally obligated for the payment of the entire debt. If the debt is foreclosed and the court sale does not bring enough money to pay the debt in full, a deficiency judgement against the assumer and the original borrower may be obtained for the unpaid balance of the note. If the original borrower has been released by the assumer, only the assumer is liable.

[b] The existence of a lien (aka mortgage) does not prevent the transfer of property ; however, when a mortgage is assumed (mortgage assumption) , the mortgagee must approve the release of liability of the original mortgagor....”

In contrast in a "subject to" transaction the buyer does not "assume" the mortgage according to the definition of "assuming the mortgage" by the mortgage company or lender. No approval or credit is needed for the transaction to take place. It is a Private transaction between seller and buyer.

Quote from “Arizona Real Estate Practice & Law”- (Dearborn Press)

Pg 132. “Cash To Loan Situations ” (Subject To)

Often a purchaser wants to “ buy out” a sellers equity position in a property and take title with the existing financing in place (aka Subject To). Such transactions are often referred to as “cash to mortgage” transactions, although – with the predominant use of trust deeds in Arizona – a more accurate phrase would be “cash to loan”.

"Three situations can arise in a cash to loan transaction, based on the relative degrees of liability for the existing financing that the seller is willing to retain and the purchaser is willing to accept. It is imperative that a licensee (real estate agent) involved in such a transaction correctly word the proposed financing arrangements in the purchase contract."

"The licensee is also obligated to inform and explain to all of the parties their rights, obligations and liabilities regarding the existing financing.

With the written permission of the original lender, a property may be sold “subject to” existing financing; and the seller remains totally liable for the payment of the loan balance even though the purchaser owns the property. In this situation the purchaser does not have to qualify with the lender for the balance of the loan. While this may appear financially risky for the seller, the risk depends on the amount of cash taken by the seller for his or her equity and the relationship of the balance of the loan to the market value of the property.

When you buy a property “subject to,” you are purchasing it subject to the existing financing. Put simply, this means that the loan(s) and any other liens or encumbrances already on the property stay there without any formal assumption on your part. The owner deeds the property to you, and you take the payment book and start sending in the payments just as the former owner did. Simple, huh?

Now..........Is It Legal?

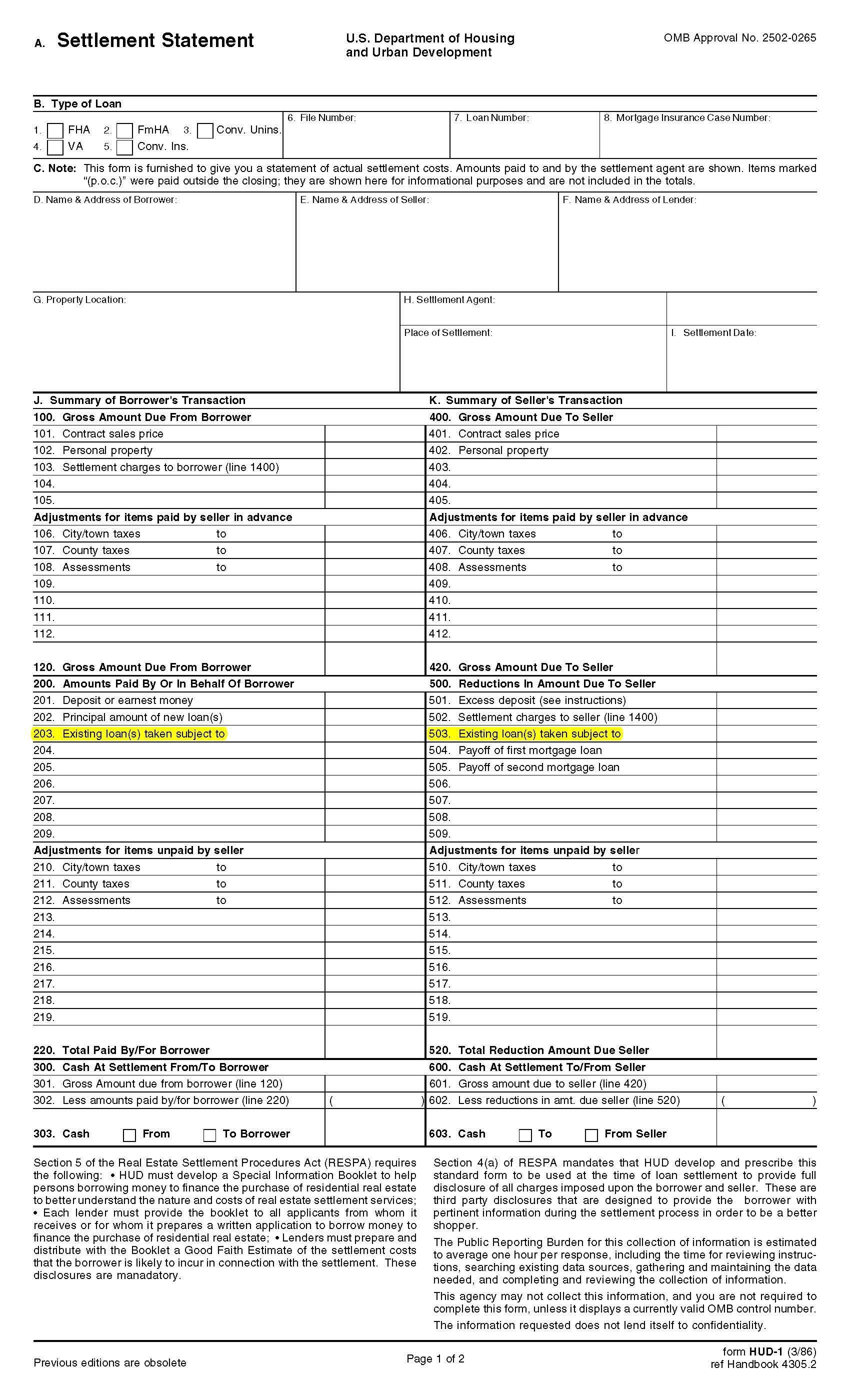

Well, don’t let one of those attorneys or real estate agents you sort through before you find the right one convince you that there is anything illegal about getting the deed. If anyone tries to pull that one on you, ask them about line 203 on the standard HUD-1 form where it says “Existing Loans Taken Subject To.”

Why Does It Work? Sellers will GIVE you their house?? Yeah, right!

“But why would any seller go along with this?” you ask. Good question. I thought the same thing in the beginning. But there are some very motivated sellers who WILL do this. Those are the ones you want. Some are motivated simply because they cannot afford the mortgage payments any longer and the lender, bank or mortgage company refuses to give them lower payments in the form of a modification and won't work with them. Bottom line is they are going to foreclose sooner or later. Involuntary foreclosure cause loss of job, reduced income, divorce, moving out of town, etc. Also known as an economic default.

You also have another group of homeowners who are called strategic defaulters. The difference with this group of home owners versus the economic defaulters is that the strategic defaulters (voluntary foreclosures) CAN pay the mortgage but refuse to do it any longer. They do not want to put money in a home that was worth lets say for example $200,000. But it is now worth 150,000. or even less. They consider this a losing investment and not only do they refuse to put more money init (throwing good money after bad) but they it does no longer serve the purpose of which they once utilized it for...to withdraw money out of the equity it once had. Can't sell it because it is upside down (owe more than what it's worth). And for some reason they don't want to go through the hassle of short sale? Possibly because of the financial information they must give up.

Any way these are just but a few types of motivated sellers who will give you their house and the mortgage with it for many reasons. I’ll say there are as many reasons as there are houses, of which I have had numerous houses deeded to me from sellers in a wide variety of situations.

There are sellers with perfect credit who are downsizing and want to stay ahead of the game. I've had one deed me a beautiful 3 bedroom, 2 bath, 2-story home which was only 7 years old and had some equity. They just needed a fast sale.

Then there was the lady who deeded an investor friend of mine a house for the loan balance of $14,000. She had owned the house for 25 years but her mother had recently died and left her another house free and clear. Although the house she deeded him needed $10,000 in repairs, it was still worth $70,000 or so after repairs. When he asked what she wanted for it, she said she just wanted to be rid of it.

Many sellers will deed you properties days and even hours away from the auction block―some might even have substantial equity, some with little equity but low-interest loans.

Not all sellers who deed you their property are “unsophisticated” or “down and out.” Some just realize that they have a problem that needs an immediate solution. You just need to know how to provide it.

Subject To is a great way to build a portfolio of income producing real estate. There are no limits because the loans are not in your name, you never have to qualify so you can buy as many as you want. It is powerful stuff. The best way to get properties without credit or cash.

It is important that the investor using this technique be well educated in the strategy and have the proper paperwork and documentation to get the properties, hold the properties, and then rent or even sell them if certain conditions permit.

So now you know a little about what Subject To is. Let's talk about what it is not.

Buying or acquiring a house "Subject To" is not the only way to invest in real estate and get houses. Subject To do is not a license to go out and sign up no equity deals that put your assets and the seller's credit at risk. Bad deals are bad deals. Just because you can get a deed doesn't make the deal good. You must have more than one exit strategy and each deal is different.

Buying Subject To does not give you the right to walk away if the deal goes bad even though you can do this. I don't advocate it. Some real estate "gurus" teach this as one of the benefits of buying using this method. When you buy Subject To you make a commitment to stay in the deal until the loan is retired. The seller entrusts his credit to you and you shouldn't take that lightly.

No matter what shape the seller let his credit get into, your responsibility here as in the rest of life, is to leave things better when you leave than they were when you found them. This includes your seller's credit. Walking away from the deal after you get it is should NOT be an option...but you can.

Subject To is a powerful, awesome technique for buying real estate. It can make you very wealthy if you do it right and I credit it for a lot of my success in real estate investing when I first started.

Use it with care and responsibility and know it's limitations and it will do wonders for you financially. Now is a good time since there are so many types of motivated sellers out there. Remember this is not for traditional sellers of property, just the motivated ones who want to let go of the house Now.

This should give you some basic understanding of what "subject to" is all about. So... IF you're finally ready to make some money in Real Estate Investing just call us below!

by Eric Brown

www.SubjectToRealEstateInvesting.com

https://www.facebook.com/groups/SubjectToRealEstat

https://www.instagram.com/subjecttorealestateinvesting/

https://twitter.com/SubToInvesting

https://www.linkedin.com/in/subjecttorealestateinvesting/

(602) 753-8775 or (602) 748-5659 SubjectToRealEstateInvesting@gmail.com

Info@SubjectToRealEstateInvesting.com